Fresh off the heels of Uber Technologies Inc (NYSE: UBER) lockup expiration period last week, another San Francisco based tech company will go through the same on November 13. Fastly, Inc (NASDAQ: FSLY) isn’t a household name like the ride-sharing behemoth.

Fastly is a content delivery network (CDN). By bringing servers and data centers closer to the end customer, it can provide the end user with a faster, safer internet experience. The CDN business is extremely competitive and investors seem to not know what to make of it. Just four months after its IPO of $16 in May 2019, the stock more than doubled to about $34 per share. A day before it’s lockup expiration day, Fastly is trading for $19 per share.

The volatility of IPO can be tough to stomach but the upside potential is appealing, especially for employees and early investors. There also comes risk. For example, six months removed from its IPO and fresh off its lockup expiration, shares of Uber stock are down 40% from its IPO price.

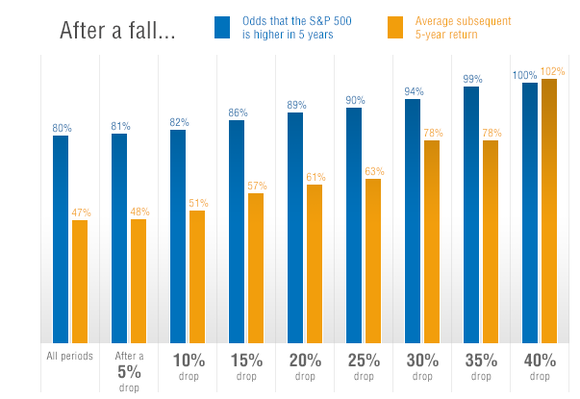

But six months does not make an investment career. For long-term investors, volatility is the price of admission and should be an after-thought when it comes to obtaining long-term wealth.

Deciding whether to hold or sell company equity shouldn’t be based on short-term price fluctuations but on financial goals, concentration risk, and company prospects. Let’s take a look at what employees of Uber, Fastly, and other soon-to-IPO companies should think about when deciding what to do when their shares become free.

Swinging for the fences

Outsized returns often come from betting against conventional wisdom, and conventional wisdom is usually right. Given a ten percent chance of a 100 times payoff, you should take that bet every time. But you’re still going to be wrong nine times out of ten.

We all know that if you swing for the fences, you’re going to strike out a lot, but you’re also going to hit some home runs. The difference between baseball and business, however, is that baseball has a truncated outcome distribution. When you swing, no matter how well you connect with the ball, the most runs you can get is four. In business, every once in a while, when you step up to the plate, you can score 1,000 runs. This long-tailed distribution of returns is why it’s important to be bold. Big winners pay for so many experiments.

– Jeff Bezos, 2016 Amazon shareholder letter

Conventional wisdom will tell you to diversify your portfolio. But a part of the intrigue of working at a young tech company is the potential for striking it big. While diversification can preserve wealth, concentration can create it. And create it fast. However, you still have to be smart about risk management.

When it comes to deciding how to divide a cash and investment portfolio, I like to think in terms of building assets into three buckets:

- Protective assets – cover necessities and short-term needs such as your home, emergency reserves, medical care, home improvements, and family vacations. Allocate cash to this bucket.

- Market assets – covers basic retirement goals, second homes, and college funding. Use a diversified portfolio of stocks, bonds, and real estate for this bucket.

- Aspiration assets – buying a dream home on the beach, early retirement, creating generational wealth, leaving a legacy, buying an NBA team, or having your own private jet. This can be your concentrated and high-risk bucket.

Once you know how much to protect and how much you need to put away to cover your basic goals and needs, you can figure out how much to allocate to company stock.

Know your risks

While the upside of any single position is much higher than a diversified portfolio, the downside is much larger too. A negative corporate event such as bankruptcy, loss of a key person, or criminal activity can lead to permanent losses (remember Enron). With a company like Fastly, which is not a necessary monopoly like PG&E, investors shouldn’t expect a bailout from a negative event such as an unrecoverable security breach. WeWork is a prime example of a company that went from Wall Street darling to pulling out of its IPO, to nearly having to shut its doors.

While you can swing for the fences, your decision doesn’t have to be all or nothing. And when you do, you don’t necessarily have to think about how your life will be affected if the stock went to zero. Bankruptcies are common but the probability is low. However, you should think about what may happen with a loss of 70%+, especially when it involves a volatile tech company.

Know your biases

Money is emotional. There’s no denying that. Naturally, money decisions are often not based on logic and the best long-term outcome. Knowing your biases will help you overcome or mitigate those emotions.

Here are some of the common behavioral biases that apply to equity compensation:

- Overconfidence and familiarity: employees feel that because they work for the company, know the management team, and understand the business, their stock will also do well. They’ll also believe they’ll be the first to know if things are getting worse. The market is very smart. Unfortunately, familiarity and confidence don’t lead to better stock market returns.

- Status quo bias: it’s easier to do nothing rather than making a change. This leads to overconcentrated portfolios with outsized risk.

- Regret avoidance: If the stock goes up, I’ll miss out on my payday and will be kicking myself for the rest of my life.

- Loyalty effects: the desire to be loyal to your employer or not be seen in a negative light in front of your peers. If you feel this way, keep in mind that your company has an exit plan. You should too.

- Price anchoring: the stock was worth double a year ago. I’m down 50% and want to gain my money back before I sell.

If you are a victim of any of the above biases, don’t be ashamed. It’s normal. But simply being aware of those emotions doesn’t always lead to an optional outcome. Asking yourself this question might:

“If I received X dollars in cash (amount of equity compensation you have), how would I invest this money?”

Is your answer going to be 100% in the company you work for? If not, you should consider selling stock when the rules allow for it.

One more important consideration

I’ll dig deeper into this in a later article, but your company’s prospects play a large part in deciding what to do with your company stock. My favorite investor, David Gardner of The Motley Fool, likes to use the finger snap test when deciding if a stock is worth holding. If you snapped your fingers today and the company went away, would people and/or business be disrupted in a negative manner? Is there an alternative? Would that company be missed?

This isn’t the only criteria. The strength of the management team, company culture, growth in revenue and cash flow, and the strength of its balance sheet also plays a part. In Fastly’s case, founder CEO Artur Bergman owns over 10% of the company. Margins are slowly increasing, and it’s winning some big customers – both signs of a better mousetrap. It’s losing money but it’s growing revenue over 30% year over year.

These are a few of the positives that led me to take a position in Fastly for my personal portfolio along with some of my risk-seeking clients. I expect volatility, especially after the lockup expiration date. However, we are diversified enough that we won’t be looking to take on a side hustle in the circus if the stock goes south.

Be sure to do the same when deciding what to do with your company stock.

Disclaimer: Palbir Nijjar and some of his clients own Fastly stock. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services.

Subscribe here to get articles sent directly to your inbox.