The following snippet is from a CBS article written during the heart of the 2009 financial crisis.

Alan Weir, who turns 60 this month, showed 60 Minutes his latest 401(k) statement, which he hadn’t had the courage to open up.

“I’m afraid,” he told correspondent Steve Kroft.

There’s good reason for his trepidation: nearly half of his life savings have vanished in a matter of months.

“It went down again,” Weir told Kroft, after opening the statement.

Overall, he said he was down about $140,000.

Asked if he thought he’d ever get that money back, Weir said. “I probably never see it come back. I was looking to retire, probably, when I hit 62. Can’t do it now. I’ll probably be working until I’m at least 70.”

Stories like Alan’s were all too common in 2008 and 2009. Similar headlines were popular during the dot-com bust in 2001. With unemployment below 5% and markets at all-time highs, it’s easy to forget about delayed retirements, foreclosures, evictions, and long lines at local job fairs. As time passes as retirement accounts grow larger, it’s easy to forget the pain of past market crashes. However, investors may be seeing some signs that it’s time to be a little cautious.

Are we in a bubble?

My favorite financial writer is Morgan Housel, who in this article pointed out that the word “bubble” didn’t even exist in the financial dictionary 25 years ago. With the bursting of the technology and real estate bubble fresh on our minds, that word is now thrown around frequently. Housel mentions that today, according to the media, we are in at least 14 different bubbles:

• A new real estate bubble.

• A bond bubble.

• A tech bubble.

• A VC bubble.

• A startup bubble.

• A stock bubble.

• A shale oil bubble.

• A healthcare bubble.

• A dollar bubble.

• A college tuition bubble.

• A Canadian housing bubble.

• A central bank bubble.

• A social media bubble.

• A China bubble.

The word bubble makes for a great headline that gets clicks but are we really in a bubble today? When I look at the tech and housing bubbles, there are two similarities that stick out to me: 1) Valuations, measured by a variety of metrics, far exceeded historical averages, and 2) A clear majority of people thought that things were going to get better forever. Let’s look at how those 2 dynamics are playing out today.

The data

One of my favorite metrics too look at when evaluating market valuation is the TMC to GNP ratio. This ratio measures the total value of all publicly traded equities (Total Market Capitalization or TMC), against the size of the entire U.S. economy (Gross National Product or GNP). The TMC to GNP ratio is often called the Buffett Indicator as billionaire investor Warren Buffett once called it “the best single measure of where valuations stand at any given moment.” He goes on to say, “If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you. If the ratio approaches 200%–as it did in 1999 and a part of 2000–you are playing with fire”. Today, TMC/GDP ratio sits at 130.8%, a level only surpassed during the tech bubble.

Another popular valuation metric is the CAPE Ratio, created by Robert Schiller, a Yale professor and American Nobel Laureate. The CAPE ratio, or cyclically adjusted price-to-earnings ratio, takes a popular valuation metric, the P/E ratio and expands it by adjusting for business cycles and inflation. The CAPE ratio is not an indicator of upcoming market crashes. Schiller’s research concludes it is an indicator of future long-term market returns.

Yet, at a ratio of 29.5, the only two times the CAPE ratio was higher than today’s level was leading up to the Great Depression and the dot-com bust.

Although the CAPE ratio appears to be at dangerously high levels, investors should be aware of a strong argument against this metric. The long-term average of 16.7 is deceiving as the denominator used to calculate the CAPE ratio, earnings, is skewed downwards as more profitable technology companies replaced lower margin industries which dominated the S&P 500 in the past. Furthermore, earnings can not only be manipulated but can vary through time as accounting rules change. Despite its flaws, the CAPE ratio is still one of the strongest indicators out there used to predict future market returns.

The emotions

When I first started investing about 15 years ago, I merely focused on the numbers. The dominant left-side of my brain gravitated towards financial statements and economic data. However, as I gained more experience, I realized that understanding human behavior was just as important as understanding data when trying to gauge the markets.

So, what is the pulse of today’s bull market? In a recent Bloomberg View podcast, legendary investor Howard Marks noted three stages to a bull market:

1. A few bright people believe there could be improvement

2. Most people believe things are getting better

3. Every idiot thinks things are going to get better forever

In hindsight, it’s easy to state that the housing and tech bubbles were discernable. How easily people forget. Middle managers quitting their full-time jobs to become day traders was a recurring theme in the late 90’s. Move forward a decade and all the talk was about how “they aren’t making any more land.” Both time periods were filled with irrational exuberance as the road to riches appeared to be as easy as buying a few tech stocks or five townhomes in the Arizona desert with no income verification.

I don’t see this type of euphoria today. In fact, the market rally of the past seven years might be the most hated rally in the history of markets. The S&P 500 is up over 230% since reaching its lows in March 2009. Yet the commentary during that entire time has been that markets are overvalued, the Fed is incompetent, Wall Street is rigged, and Bitcoin will rule the day. Additionally, the political divide is larger in the U.S. than it has ever been. The national debt is still at high levels. Interest rates have been at or near zero for nearly a decade. But rather than ignoring these facts, there appears to be general concern with those that pay attention to this kind of stuff.

Although the data shows stretched valuations, the euphoria that exists during bubbles is not as prevalent as it has been in the past. This doesn’t mean there won’t be a correction. In fact, there will be. There always has been. It’s a part the cycle.

The S&P 500 has fallen 10% or more from recent highs a total of 46 times since 1929, an average of about once every couple of years. The definition of a bear market is a drop of 20%. The S&P 500 has experienced a bear market over 20 times, or once every four years. We last saw a 10% drop in January 2016, which is about on schedule. The last time there was a 20% drop was nearly 6 years ago (it was a 19.4% drop but let’s call it a wash).

It’s a matter of time before we see another bear market. We’re due. However, that doesn’t mean it will happen soon. Although markets appear to be overvalued, nobody has been able to predict downturns and it’s no different this time. Therefore, pulling your money out of the market completely could mean you can lose a lot of money.

So what should you do?

You hear this term diversify all the time but what does this word really mean? Of course, you don’t want all your money in Groupon stock but is investing in a S&P 500 index fund diversified enough too? Many investors investing in the S&P 500 gets broad market coverage at a low cost but the problem is that your portfolio will only be in the largest U.S. companies. It ignores the rest of the investment universe, not only across the U.S., but across the globe.

What’s wrong with owning just the U.S. market? Sure, it’s comfortable. It’s like that warm and fuzzy blanket you wear when watching seven straight episodes of Narcos. However, the total market value of the U.S. stocks is only 43% of the global market. As a share of GDP, the U.S. is only 20% of the global share. Yet, according to Vanguard, U.S. investors have 72% of their portfolios in U.S. stocks.

If you had all your money in U.S. stocks since the market lows of March 2009, this concentration wouldn’t be a bad thing. The U.S. market has been much stronger than global markets since the Great Recession. However, this is not always going to be the case. Going forward, investors should expect much lower returns. Going back to the CAPE ratio, long-term returns with the CAPE ratio above 25 has only been about 1% when adjusting for inflation. Returns have been negative when they go above 30. Recall that the CAPE ratio is at 29.5 today.

A diversified portfolio means buying a variety of asset classes. An asset class can consist of investments in government bonds along with stocks of large, medium, and small companies. It will also include international stocks and bonds, real estate, and commodities. A diversified portfolio that invests in each of these asset classes won’t always get you returns as high as you would if you focused on a single asset class. However, there’s no way of knowing which asset class will outperform the others. If there was, I would still be blogging…it would just be from Belize.

The goal with diversification is not to outperform everyone else but to have a portfolio that will do well in multiple markets. It’s to keep you in the market when things go awry.

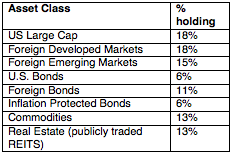

Let’s look at a diversified portfolio in action. In his book, Global Asset Allocation: A Survey of the World’s Top Asset Allocation Strategies, author Mark Faber looked at the returns and volatility of various asset strategies. One of the better performing strategies was that by former Harvard endowment chair Mohammad El-Erian. His portfolio strategy consisted of the following asset classes:

Below is how this diversified portfolio performed.

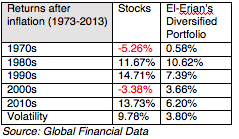

Notice how the diversified portfolio trailed stocks when they were going up. However, during bear markets, losses were protected. Additionally, volatility was significantly reduced. A diversified portfolio netted positive returns in a variety of investment environments while only having 25% of the volatility. This is important as investors will more likely not regretfully sell their entire portfolio in the event of an inevitable bear market.

Other strategies

Money is emotional. Academic studies show that the best time to invest is always today rather than time the market and attempt to get in or out at the best moment. If we were all robots, this would be a great strategy. However, many people have been left with a sour taste in their mouth regarding Wall Street and that’s okay. Others are fearful of an overheated market and that makes reasonable too. If your worried about what the future holds, focus on the following:

1. Change the focus of your hard-earned dollars. A good start would be paying down some debt. It could also be a good time to get to that home remodel you’ve been putting off. Do you have enough of an emergency fund that can something unexpected occurs? Basically, use this time to evaluate your personal financial situation outside of the investment world.

2. Start hoarding cash. Rather than selling out of your investments which is one of the biggest mistakes individuals can make, just stop contributing for a little while. If you receive a tax benefit by investing in your 401k, you should still take advantage of it. Most plans give you the option to invest in cash or other low-risk investments. It’s no guarantee that the market grants you a buying opportunity, but if it does, you’ll be ready to make your cash work at a cheaper price.

3. Don’t change a thing. The number one factor in determining investment success is time. Going back 40 years, an investor could have only added to the market just before a big crash and they still would have made money if they held on during the rough patches. If you have years ahead of you and don’t need to tap your investment portfolio anytime soon, just keep investing what you can and ignore the market gyrations.

4. Know where you stand. Contrary to not changing a thing, if you are close to retirement and will be reliant on your investment portfolio, take a close look at your portfolio. Make sure you aren’t putting yourself at risk of becoming a 60 Minutes story. However, you also must be mindful of not getting too conservative and putting yourself at risk of running out of money during retirement. I know a good financial advisor who could run the numbers and assist in letting you know where you stand.

To be clear, I’m not making a market call on a stock market correction or bear market. The global markets are complex and nobody has been successful in finding a secret formula that predicts short-term movements. However, having a diversified portfolio and sticking with it during good times and bad has proven to be a winning strategy over the long-term.

Need help building that diversified portfolio or just want a 2nd opinion? Allow us to help you create a portfolio built for a bull or bear market. Get started today by clicking the link below for a FREE consultation.