Well, it looks like some normalcy has returned to the markets. After 18 months of steady stock market gains in one of the lowest periods of market volatility in history, we are starting to experience some discomfort. The financial media has been their typical self and have done a good job of reporting just how normal (sarcasm) the downward swings are. Here are some actual headlines over the past week:

- Dow Experiences Biggest Point Drop in History

- S&P 500, Dow Suffer Biggest Weekly Decline in More than 2 Years

- The Dow Jones Industrial Average Crash Raises One Question: Is the World Ending?

- Market on course for 6% drop, biggest one-week fall since 2008

I don’t want to discount the downturn. Yes, the 1,100-point drop in the Dow on Monday was the largest in history. However, on a percentage basis, which is what investors should be looking at, it was the 538th largest decline in history. This of course, doesn’t make a for a good story. If I was a headline writer, here is what I would have written (and subsequently receive zero clicks, leading to a prompt termination):

- Dow Experiences 25th Worst Loss since 1960

- S&P 500 Declines to Levels Not Seen Since November 20th – Yes, 2.5 Months Ago

- The World Fails to End…Again

- Market Drops 6% in One Week after Increasing 234% over 9 Years

What happened in the markets over the last week can be scary but it’s also normal. The S&P 500 and Dow has officially reached “correction” level which is defined as a 10% downward movement from peak to trough. A drop of this magnitude in such a short period of time should not be discounted. However, it also need to be into perspective. This is the 91st time a 10% correction has occurred since 1928. If stocks fall another 10%, which is entirely possible, it wouldn’t be outside of the norm either. A 20% drop, officially a bear market, would be the 22nd since 1928.

No panic here

One lesson I learned over the past week is that I have the best group of clients an advisor can ask for. Although small in terms of quantity, they are robust in composure. A parent at my child’s school said to me yesterday, “Man…your phone must be overheating.”

Nope.

Quite the opposite actually. I didn’t receive one phone call, text, or e-mail. My clients were not worried. Nor were they surprised. In fact, they frankly didn’t care. Instead of worrying about markets they can’t control, they were busy controlling what they could — yelling at their kids, enjoying the perfectly normal February sunshine, and debating what wine to drink with barbeque (Syrah…or better yet, beer). It was the same attitude I had which tells me that I’m blessed to be in a bunch of perfect marriages.

The biggest investing mistakes usually made are emotional, all-or-nothing decisions when the market is in free-fall. A necessary part of a good advisors where he or she adds the most amount of value is talking their clients off the ledge. While I’m prepared to have this conversation, given the strong bull market, I haven’t had to. This was my first opportunity and it hasn’t been necessary. In fact, a strong stomach from my clients opens up the door to some tremendous opportunity –taking advantage of a downturn.

Strategy to feed the bear

“We’re rich because we were smart when others were dumb” – Charlie Munger, Vice Chairman of Berkshire Hathaway

The above isn’t an exact quote. I’m paraphrasing something I heard Warren Buffet’s partner say during one of Berkshire Hathaway’s annual meetings. Nonetheless, his point is valid — the best time to buy stocks is during times of panic.

However, this is easier said than done. Buying low makes complete sense and every investor can’t wait to do just that. The reality is that when asset prices fall they become sellers rather than buyers.

A 10% drop from arguably extended valuation levels is not exactly a buying opportunity of a lifetime. That likely occurred in 2008 and 2009 and it’s a market we likely won’t see again during our lifetime. However, today is a better buying point then last week, and the odds that the market will be higher 5 years from now has increased.

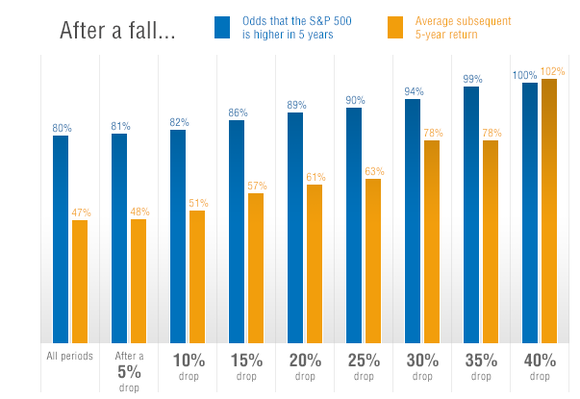

According to research from financial columnist Morgan Housel, after a 10% drop from its peak, stocks are higher in five years 86% of the time. The average return during those five years is 51%. After a 20% drop, those numbers increase to 89% and 61% respectively. Logically, the larger the drop, the higher future returns will be. And there’s a higher probability of achieving those higher returns. That’s not a bad deal.

While logic states you should deploy your cash now, the fear of regret is going to overpower logic. Here are some perfectly normal thoughts you may be having right now:

What if the market drops even further? It’s too early to start buying.

This feels a lot like 2000 and 2008. What if we have another crash? I don’t want to feel that pain again.

This time, I’m going to be aggressive when others panic.

The market may continue to fall. It might not. If you invest your reserves now and it falls further, you’ll be kicking yourself. If it doesn’t, and you don’t buy, you’ll be kicking yourself.

To be a successful investor, you don’t need to time the markets. You need to control your behavior. Therefore, you need a strategy that’s rule-based, taking the emotion out of your investing decision. Let’s say you have $10,000 in dry powder that you are ready to invest during a downturn. Instead of investing it all in one chunk or waiting too long, a rules-based strategy on deploying a set amount at various drawdowns is a sound strategy. The approach I’m going to show you is adopted from Morgan Housel who articulates it much better than I in this article. Here is a summary:

| Market falls | You invest… | Historical Frequency |

| 10% | $1,000 | About once a year |

| 15% | $2,000 | Every 2 years |

| 20% | $3,000 | Every 4 years |

| 30% | $2,000 | Every decade |

| 40% | $1,000 | Few times in an investing lifetime |

| 50% | $1,000 | Once in an investing lifetime |

With the strategy above, more than half your available funds will be invested after a 20% decline. Larger declines are rarer, so it makes sense to invest sooner rather than later. However, in the event that the market continues its descent, you’ll still be able to take advantage of lower prices.

Significant wealth can be created during bear markets which fortunately, yes fortunately, also occur pretty regularly. We haven’t had a 20% decline since 2009, twice as long as the average frequency. While not predictable, it shouldn’t be surprising if such a drawdown occurs again.

Whether this strategy is followed with the precision of an olympian archer is not important. What is important is prepared and having a strategy. A simple plan will alleviate mental stress which in turn, leads to less hasty decisions and ultimately, better returns.

Allow me to help you create a portfolio built for a bull or bear market. Get started today by clicking the link below for a FREE portfolio review.